In this second part of what you need to know about RPGs in China, our friends at MyGamez look at the Android market, with lessons from Chinese channel experts from Xiaomi, Vivo, and Tencent. If you haven’t already, make sure to check out part one here.

The current situation is that there are no major western RPGs in China on the Android side. This is not to say there is no potential, but the competition is fierce, and the market is very top-heavy.

The size, quality, and thus, the development cost of Chinese RPGs is exceptionally high. Many titles easily rival some of the RPGs we’re used to seeing on the PC or console side in the west. The development time for an average Chinese RPG is often a couple of years with dev teams that are 50+ strong. And games are developed almost purely for the Chinese market by big Chinese companies with deep pockets for marketing and experience making RPGs that appeal to Chinese players. With that mind, let’s look into some characteristics of the Chinese RPG market.

User habits play a key role

As mentioned in part one, RPGs aren’t nearly as big a thing in the west as they are in China. One simple reason is that the overall gaming habits on mobile are quite different. For many Chinese, a smartphone is their primary gaming device, whereas a PC or console serves that purpose in the west. With countless high-quality RPGs available on mobile, the hard and mid-core players are often happy simply playing RPGs on mobile instead.

[Photo by Hu Yuanjia/for China Daily]

The high-paying users that are really into RPGs are generally from tier 1 or tier 2 cities. They are more likely running high-end devices, with iOS common as well. People living in tier 1 and 2 cities are also more exposed to and interested in Lord of the Rings-like western fantasy themes common in western RPGs, with orcs, elves and such. The recently concluded Game of Thrones was also very popular among this audience.

In contrast, some of the current top android channels, such as Vivo and Oppo, are much more popular in lower tier cities. Their best-selling devices are also mid-to-low-end, and the user’s gaming habits are less demanding. In other words, they tend to play casual games instead of RPGs. These users aren’t too familiar with western fantasy themes, but instead, watch Chinese fantasy films and TV.

Tencent users, on the other hand, lean clearly towards the more mid-to-hardcore side, and RPGs are thriving on their app store. As mentioned earlier, out of the top 500 grossing games on China iOS, RPGs command 56%. On Android overall, this figure is closer to 70%. Some hardcore players may spend half or even more of their disposable income on their favorite title(s) every month.

Also touched upon by the Chinese channels participating in MyGamez’s China Game Day Helsinki panel was the need to make the game “simple.” It may sound a bit funny, but the average Chinese person faces a lot of stress and pressure. There’s pressure to pay off your mortgage and car payments and take care of the kids and parents. This makes for a stressful combination when combined with lots of overtime and lack of a safety net in the form of social welfare if things go downhill.

As analyzed in part 1, most top Chinese RPGs feature auto-play, and the previously mentioned cultural aspect is one of the key reasons for this. People don’t want to add extra stress into their lives because of a game. Auto-playing some dungeons and getting rewards to progress is a way to alleviate the stress of daily life. The controls and mechanics should not be complex, and generally western titles are heavier on combat complexity than Chinese titles.

An example of RTS games on the PC side was brought up in our China Game Day panel discussion. RTS games are generally some of the most strategically and mechanically demanding games out there. While such titles of course still have fans in China, when a simpler alternative in the form of MOBAs came out, most people quickly switched to playing those instead.

Own-channel distribution with 99% revenue share

One extremely interesting aspect widely employed by publishers of RPGs in China is what we call own-channel distribution. Essentially this is what Epic is doing in the west with Fortnite – skipping Google Play and their 30% cut – and distributing the game through their own website. For comparison, the revenue share on Chinese android channels is 50/50 after a 5% payment method fee, effectively leaving you with only 47.5%.

With own-channel distribution, you only give 1% to the payment provider (AliPay or WeChat pay) and keep 99%. Just think about the ROI on paid UA! The hardcore gamers who typically enjoy these RPGs are also tech-savvy enough to find your website to install the APK. Therefore, providing some extra in-game gifts, or perhaps the newest update slightly earlier through your channel is an easy way to lure fans to download the update from your website. Channel experts from Xiaomi, Vivo, and Tencent revealed that this is actually the most prominent distribution channel, at least in terms of revenue, for big Chinese RPG titles.

Western titles’ potential and challenges

Age of Magic’s potential on Android

With the Chinese industry experts and Playkot, we also discussed Age of Magic. As mentioned in part 1, the game is doing great on China iOS, which should bode well for it on the Android side as well. Right?

Age of Magic does indeed have strong potential on the Chinese Android market. However, western fantasy themes are still somewhat alien to a lot of Chinese players. The reference point used was to think about how many people are into Chinese fantasy (Kung Fu / Three Kingdoms / Journey to the West / etc.) in the west. Roughly the same proportionate amount of Chinese people (mostly from tier 1 and 2 cities!) are into western fantasy. In other words, western fantasy does have its fans, but that group isn’t as big as we think. As for the art style of Age of Magic, the channels all agreed that it fits the Chinese market very well, but that adding more Chinese-themed characters and environments always helps.

The channels pointed out that gameplay-wise Age of Magic doesn’t bring anything new to the table compared to its Chinese rivals. Although, the western theme and of course, gorgeous graphics should allow it to set itself apart. However, as mentioned earlier, the average Chinese Android (i.e., low-to-mid-end device) user typically enjoys casual titles, so this type of game is not for them.

Challenges western developers face entering the Chinese market

Western studios do face some challenges when bringing their RPG into China. The absolutely ruthless pace of content updates needed to keep your audience engaged and from just jumping to the next RPG is one. With Chinese studios used to cranking out massive amounts of content, this is where western studios are most likely to falter.

Running Live-Ops may pose another challenge for western studios without a solid understanding of Chinese player habits. The end-game in RPGs, in particular, is often based around social functions and rankings such as Guilds raiding together and various live-ops events e.g., limited-time dungeons and large scale PvP events.

This leads us to the final point of how some Chinese RPGs continue to monetize through constantly opening new servers, a method rarely used by western studios. Chinese users are highly competitive and willing to spend large amounts of money to get that coveted top server rank, and the associated rewards that come with it.

Chinese RPGs tap into this by opening new servers every few weeks, funneling in just enough new players to get competition (and spending) going. Players who fail to reach the top can start over on a new server, giving them another chance at glory and spending some more money.

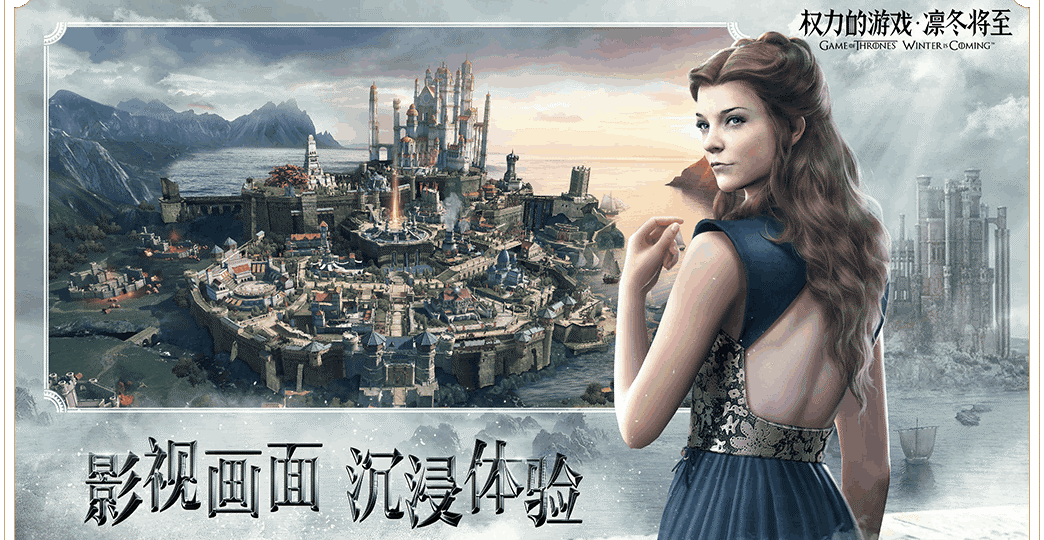

Another emerging trend is Chinese-developed games based on big western IPs. Youzoo-developed and Tencent-published Game of Thrones strategy title was just released on July 10th in China. Another example is the upcoming Diablo Immortal, developed by Netease. It will be interesting to see how these titles do, both in and out of China.

To Conclude

To conclude, the Chinese RPG market is certainly tough to crack. But Chinese players’ yearn for new RPG experiences may open the way for some western titles finding significant success in China. Here are a few key takeaways:

- Keeping your game simple will help you appeal to a wider Chinese player base

- Including “autoplay” is a must

- Own channel distribution is king in China to maximize revenue

- Western studios face challenges in terms of the pace of content updates expected by Chinese players

- Understanding Chinese player habits is crucial for successful Live-Ops

If you enjoyed reading this post, here are a few more you should definitely check out: