The mobile games industry is incredibly competitive, with publishers constantly looking for new ways to innovate as they seek to keep players engaged and coming back for more. December saw yet more new ideas, with Match Masters adding a new power booster to its gameplay, while Brawl Stars added a brand new narrative-driven event, imaginatively titled ‘Who peed in the pool?” We’ll let your imagination work out what that might be about…

Party games tend to get a boost over Christmas, as people get together and reach for games the whole group can play, sending some games up the download charts – for a week or two, at least. Examples we’ve looked at are Imposter Game – Fakeit and Charades – Family & Party Game. But what about a mobile game that requires a real-life bow and arrow set in order to work? That’s exactly what you get with AccuBow, a game that’s not new, but which gets a big Christmas boost every year.

Another trend we saw in December involved a certain bespectacled wand-waverer; yes, we’re talking about Harry Potter. Such an incredibly successful IP is a surefire winner when used for tie-ins and seasonal content, and Monopoly GO!, Fortnite, and Rocket League all saw comprehensive collaborations over the holiday season.

Finally, as a post-Christmas treat, the GameRefinery team reached deep into their Christmas wishlists and has shared some of the key gaming trends they think will be big in 2026. We’re talking UGC, Hybrid Casual, and more China-based publishers launching successful games beyond the puzzle and 4X categories they have traditionally been strong in.

December’s Casual Game Updates

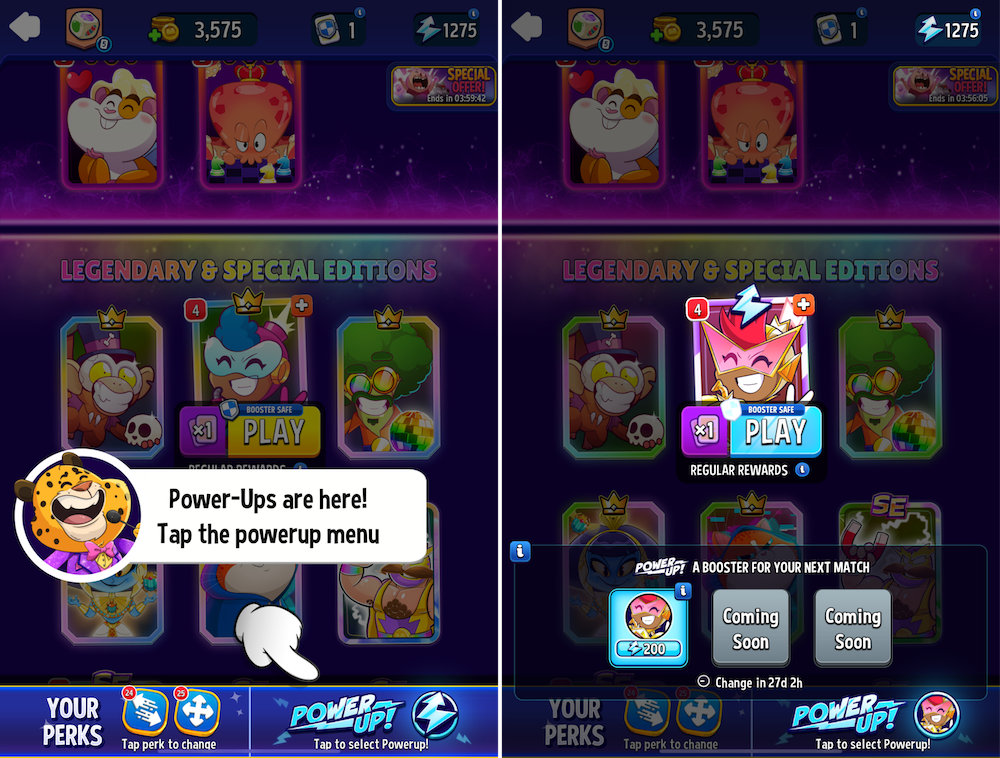

Match Masters’ December update added a new twist to the puzzle playbook: Booster Power-Ups. This new mechanic lets players increase the power of a single booster for one match or level by using a new currency called Energy. Beyond the gameplay impact, Energy effectively creates an additional monetization layer, giving players a new way to pay for incremental power.

Not every booster is eligible. The roster of power-ups is limited and rotates monthly, which helps keep the system fresh and engaging. Players can acquire Energy via in-app purchases, event rewards, and the webstore. The update introduced two new events: Booster Run PvE mode, offering free use of boosters, and Stamp It!, a monetization event.

Umbrella events that connect together the different permanent gameplay systems (for example, meta progression) with concurrent live events are nothing new. Seasonal collectible albums have leveraged this kind of player motivation for years, and typically over longer ‘season’ cycles that can last 2-3 months.

More recently, the same motivation has been applied to short-term formats, most notably multi-phased umbrella task events (i.e., a player needs to complete a task that has multiple steps in order to get the reward or achievement). These kinds of events are becoming more widespread across the casual market, appearing in titles such as Royal Match, Coin Master, Gossip Harbor, and Match Factory, and this month, we saw Toon Blast and Royal Kingdom also include them.

Additional Casual Gaming Highlights and News

Fans of the interactive story genre were given a treat in December, with the most exciting launch in quite a while, thanks to Episode Interactive, which released its first new interactive story title in years: Episode: Reality Stars.

The game quickly gained momentum, climbing as high as #35 in Downloads and #79 in Grossing, and it’s currently holding steady at #90 Grossing in the US. That’s a standout performance; these metrics mean it’s significantly outperforming the original Episode game and is now competing for the top-grossing interactive story position in the US, going head-to-head with Love and Deepspace.

A big driver of this improved performance is how modern the new game feels. Reality Stars isn’t just a library of stories—it has real meta progression and engagement/gamification systems layered on top, making it feel closer to a full-fledged game than a story app. That matters more than ever, as traditional interactive story titles face growing pressure from mini-drama apps like ReelShort.

Because the holidays are a time for friends and family to gather together, party games see a spike in performance during December. Sometimes there will also be a surge in downloads for certain games that are linked to Christmas presents, and this year this was definitely the case. Some of this year’s highlights were:

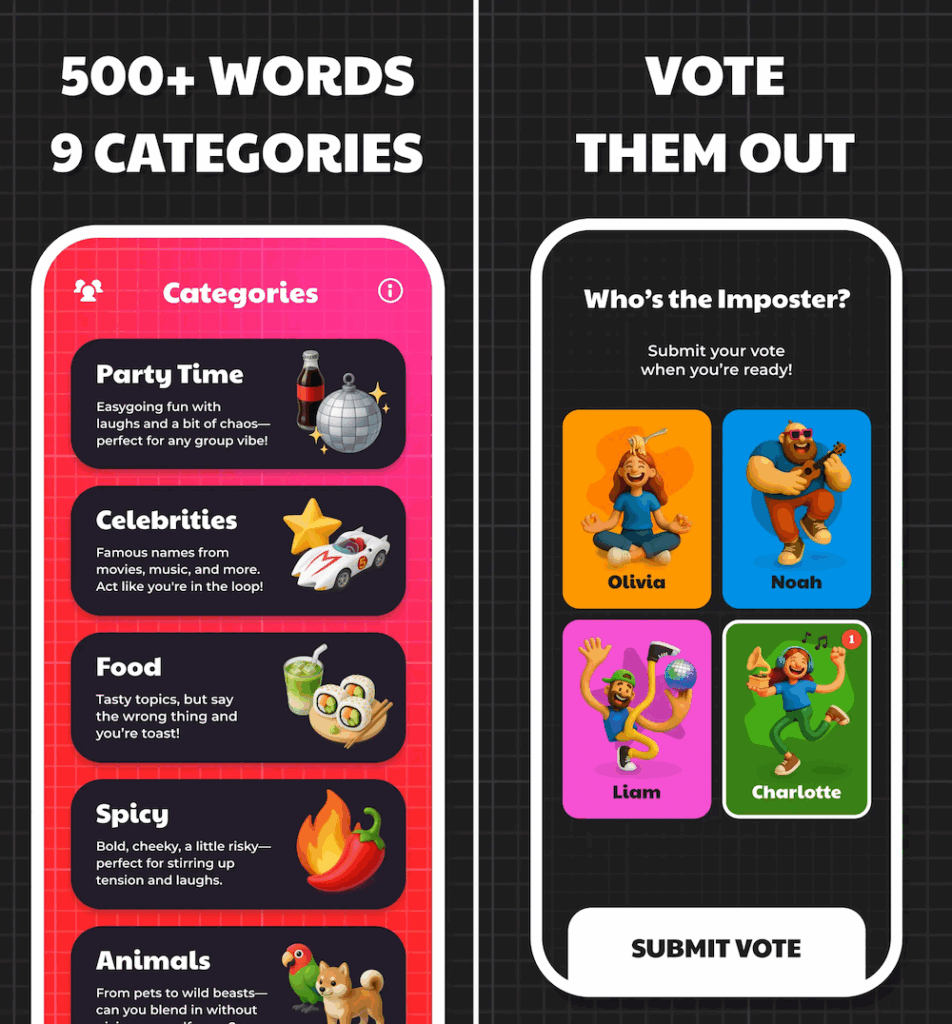

- Imposter Game – Fakeit: This is an asymmetric party game played on a single device. All players except one get to see a word that everyone then tries to talk about. After the discussion comes a voting period during which people try to guess who the imposter is. The game was launched in August 2025 and experienced significant growth during December, likely due to social media virality and the holiday season. The game peaked at #9 in the Download charts and #174 in Grossing.

- Charades – Family & Party Game: In this game, one player places the phone on their forehead with a word, and others then give hints for it. The player with the phone tries to guess the word. The game briefly entered the top #200 Grossing at the end of December.

- AccuBow: This is an archery game that is designed to only work with a dedicated peripheral, the AccuBow. The user mounts the mobile on their AccuBow, and can aim at virtual targets and animals with the app acting as a virtual viewfinder (there is also a dedicated VR version of the bow for the Meta Quest). The game was originally released back in January 2019 and since then has seen a big download spike every December 26th as people are given the AccuBow as a Christmas present, unwrap it, and download the app. This year, the game peaked at #73 in Downloads and #138 in Grossing. This year was also the first time the game reached the top-grossing #200.

December’s Midcore Game Updates

The annual Harry Potter movie marathon graced the screens of many people this Holiday season. As well as giving us plenty of hours of movie entertainment, the Wizarding World seemed to be a popular source of collaboration in live service games on different platforms and genres. Here are a few that caught our attention:

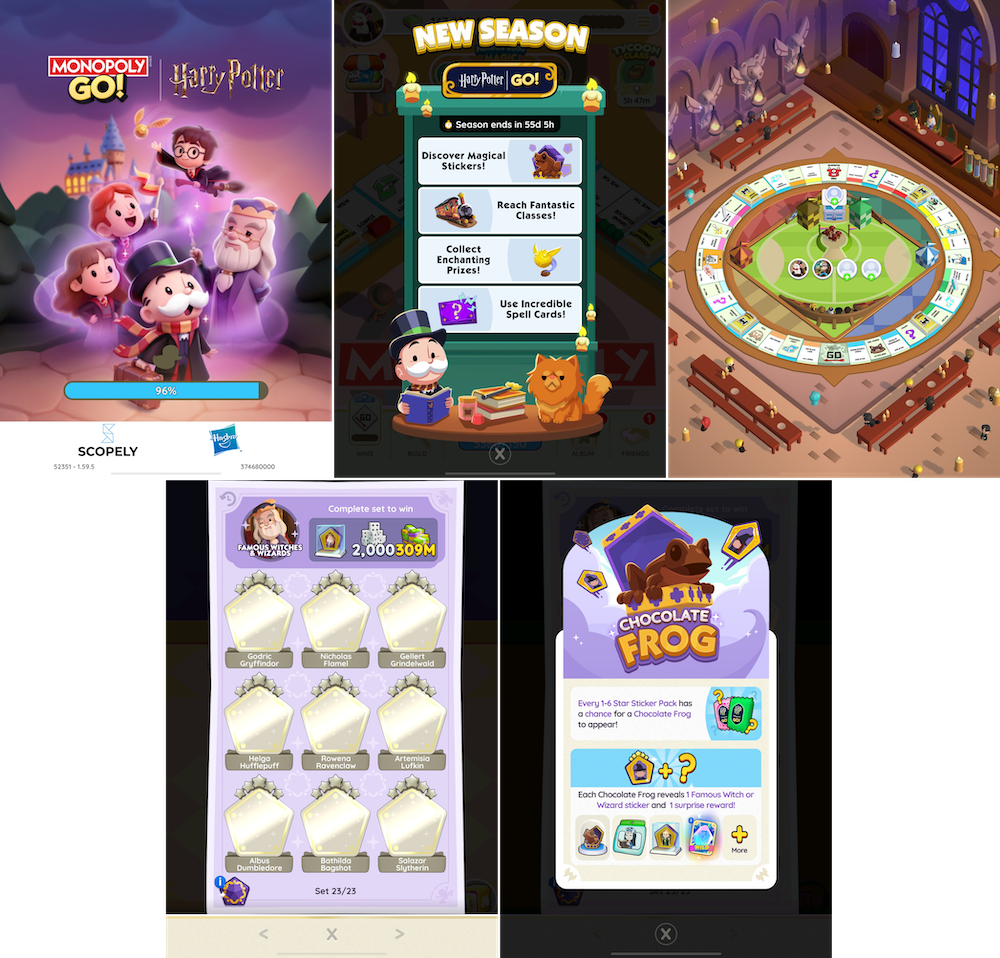

Monopoly GO!

- At the seasonal reset, Monopoly GO! launched Harry Potter GO!, a full-fat IP collaboration that functioned as an overarching theme across the month’s live-ops rotation (e.g., the Seasonal Collectibles Album, Partner Race events such as Quidditch and Hogwarts, themed minigames including Treasures and Drop iterations, alongside milestone events and offers)

- There was also the notable addition of Chocolate Frogs! These were a collaboration-exclusive bonus drop mechanic tied to the Seasonal Collectibles system. Chocolate Frogs could randomly drop from any Sticker Pack, guaranteeing a sticker from the Famous Witches & Wizards set (the highest level set consisting only of 5-Star stickers) and adding an extra reward chase layer on top of the standard album collection.

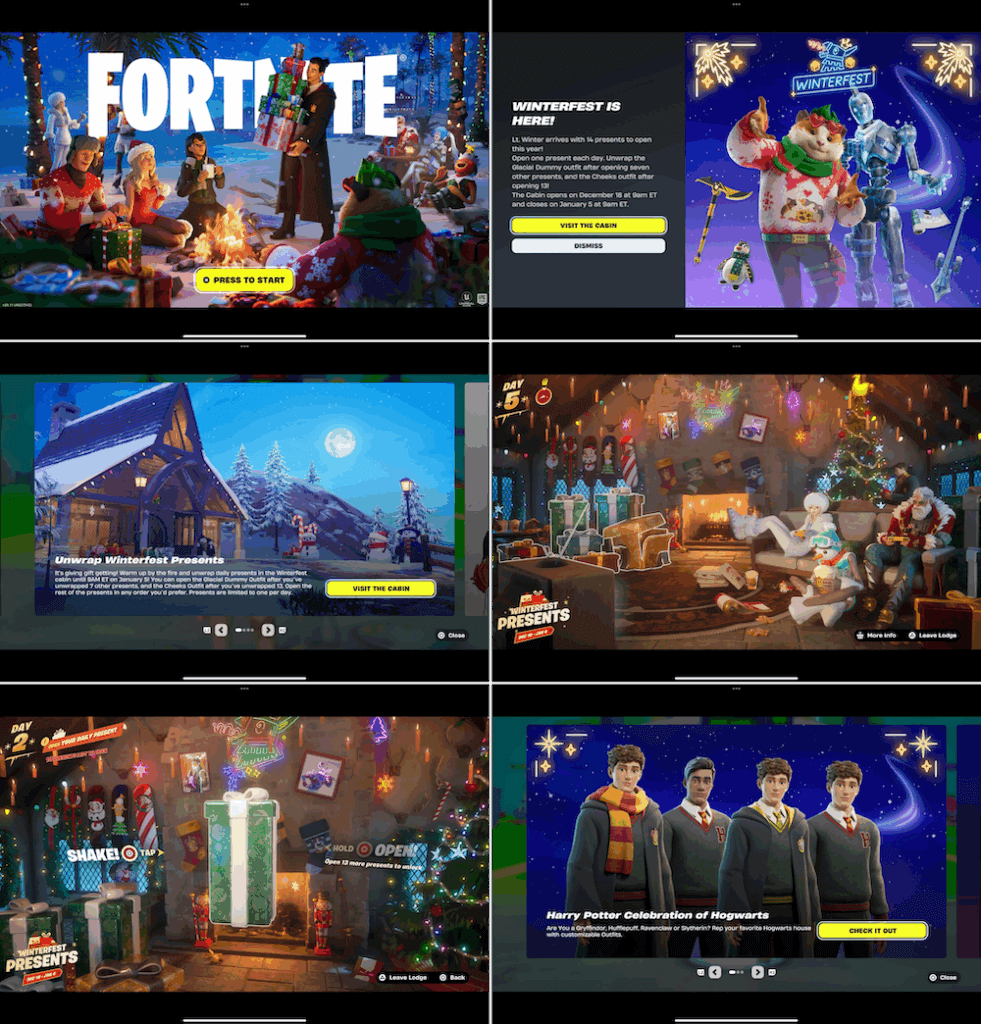

Fortnite

- Fortnite held its annual Christmas and holiday season event, “Winterfest,” which brought a variety of seasonal events, including themed Battle Royale map alterations, additional XP quests, Winterfest-themed cosmetic offers, and the annual Winterfest Presents -login event, which this year included a special collaboration with the Harry Potter franchise. On top of the revamped Winterfest Presents event cabin, the collaboration also offered players a chance to purchase themed outfits and other Wizarding cosmetics.

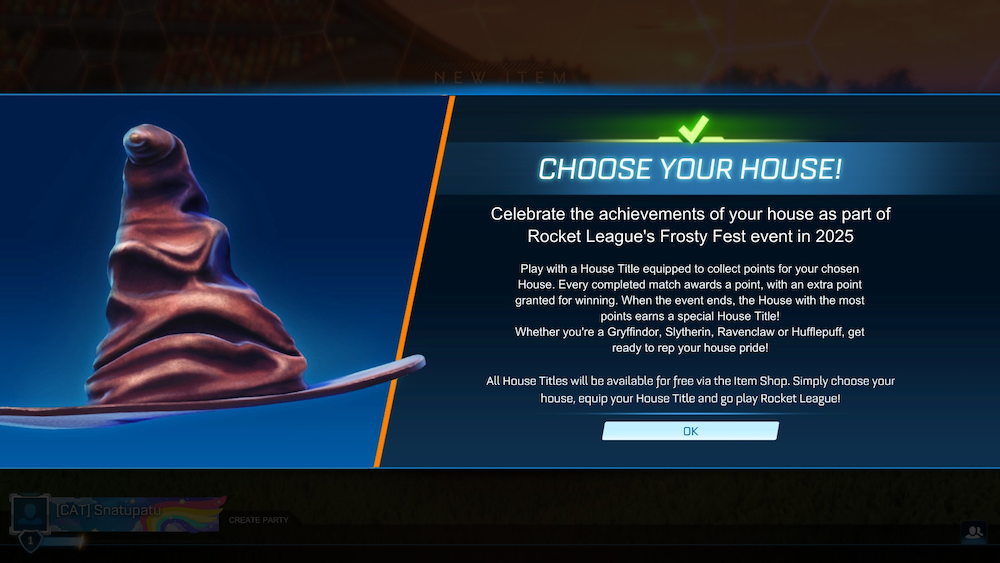

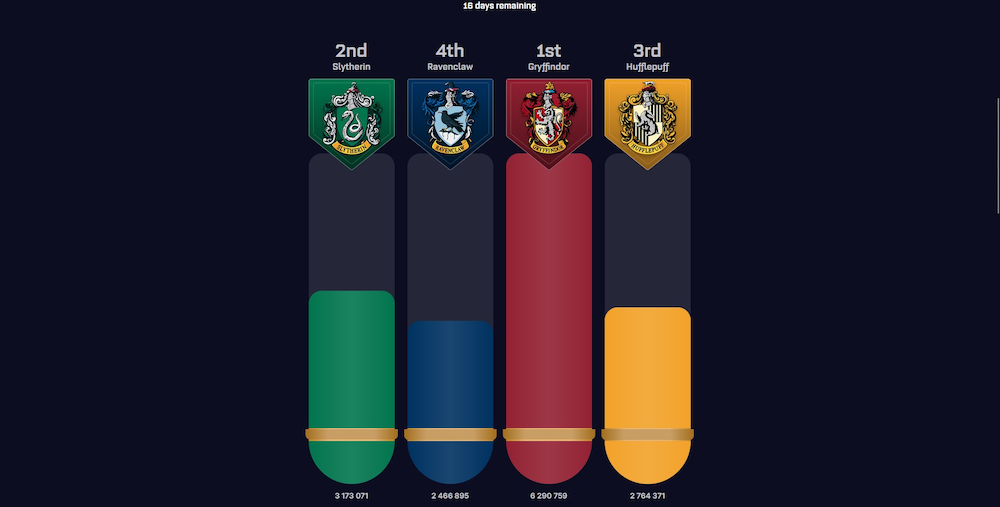

Rocket League

- In December, Rocket League introduced a new live event called Wizarding World (Harry Potter) x Rocket League. Part of this was the Hogwarts House Rivalry, a ‘’faction-based’’ competition where players chose from one of the four Hogwarts Houses by equipping themed player titles (e.g., Gryffindor, Hufflepuff, Ravenclaw, Slytherin). By playing matches during the seasonal event, players contributed their scores towards the total score of their chosen House.

For PC gamers with time on their hands over Christmas, the Harry Potter: Hogwarts Legacy was also claimable for FREE in the Epic Games Store in the run up to Christmas Day.

The popular mobile FPS Call of Duty: Mobile introduced the game’s first-ever extraction shooter mode, DMZ: Recon, inspired by the DMZ mode from the console/PC game Call of Duty: Modern Warfare II. It’s a Player vs. Player vs. Environment mode where players face both hostile AI forces and other players. During each deployment, players explore the map, engage in combat against enemies, complete objectives, and gather loot. Any items collected are only kept if the player successfully extracts before the match ends.

DMZ: Recon operates in a seasonal format, offering ranked progression, seasonal collectibles, and various missions to work toward. Permanent progression systems include Talents and Trust Level, which allow players to shape their playstyle and unlock additional services and higher-tier equipment in the Black Market.

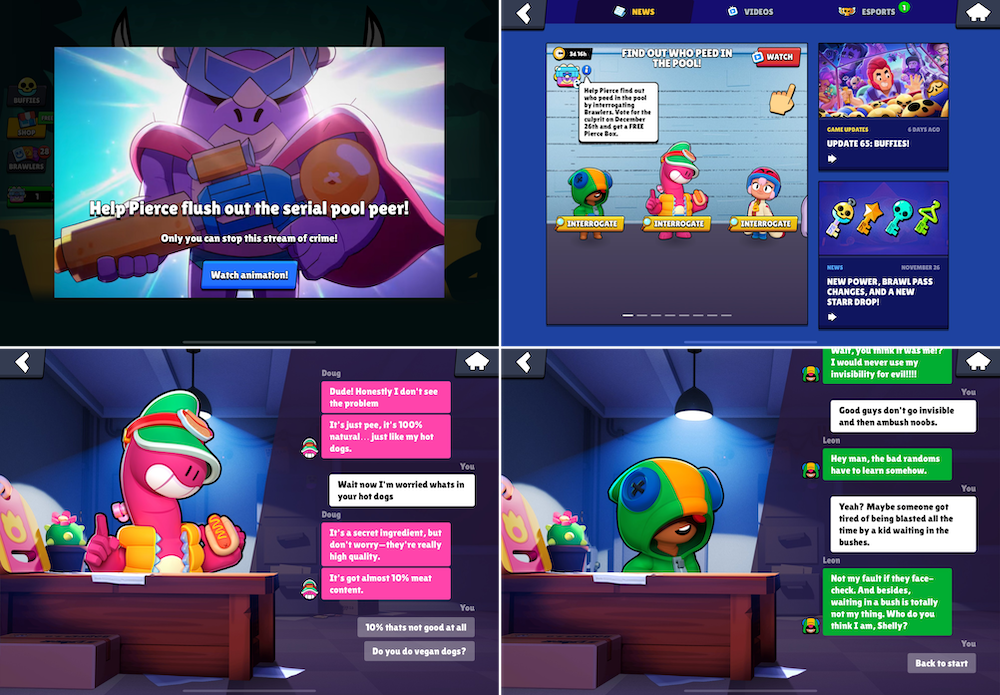

Supercell’s hugely popular title Brawl Stars introduced an interesting narrative-driven task event: Who Peed in the Pool? In a creative and quirky addition to the popular mobile game, players were prompted to interrogate different Brawler ‘suspects’ through dialogue choices. Having spoken to their suspects, the player votes for who they think is the real culprit, and on the final day of the event, everyone who had voted earned a free Pierce Box

A set of 3 Brawler suspects ready for questioning was unlocked daily. Some could be re-interrogated, and some even offered players additional rewards as bribes based on dialogue choices made. At the end of the event, players were not actually revealed the right choice, but instead left to speculate – perhaps setting the story up for subsequent installments? Additionally, the event managed to spark community speculation around the true culprit on sites like Reddit, with fans discussing clues hidden in the dialogue choices and supporting videos released on Brawl Stars’ social channels.

Even though Supercell has looked to develop an ongoing narrative around the game through video clips and themed seasons, this appears to be a rare example of a dialogue narrative being included directly as an interactive gameplay mechanic. Even for Brawl Stars (the studio’s most narrative-driven title), this represents a completely new kind of event. Running concurrently with the New Brawler Unlock Event for Pierce, it also functioned as an extra narrative layer around his introduction, providing background context, motivations, and story framing through the in-game dialogue and supporting videos.

Additional Midcore Gaming Highlights and News

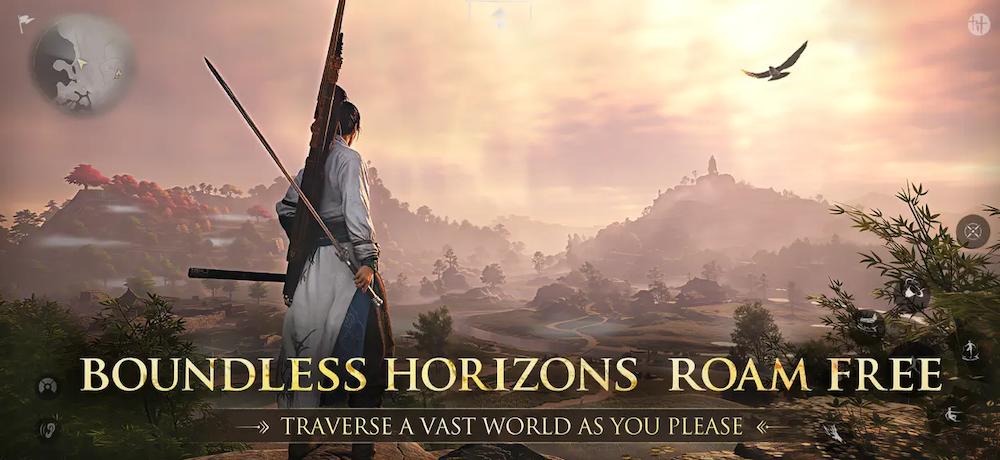

Where Winds Meet is NetEase’s newest high-production-value Wuxia ARPG/MMORPG to reach Western gamers, featuring a vast open world and a cosmetics-driven economy. The game has already launched in China, where it delivered solid performance.

The game expanded to PC as a cross-platform global release in November, including a launch on Steam. On PC, it achieved impressive traction, peaking at around 250K concurrent users. While the number of active players has gradually declined, the game continues to retain a strong baseline of approximately 80K daily concurrent users.

On mobile, the game launched globally on December 10, quickly climbing the download charts and peaking at #61 in Grossing. However, mobile performance appears more “shark-fin” shaped: the game declined rapidly down the Download rankings and has already fallen outside the top #200 in Grossing.

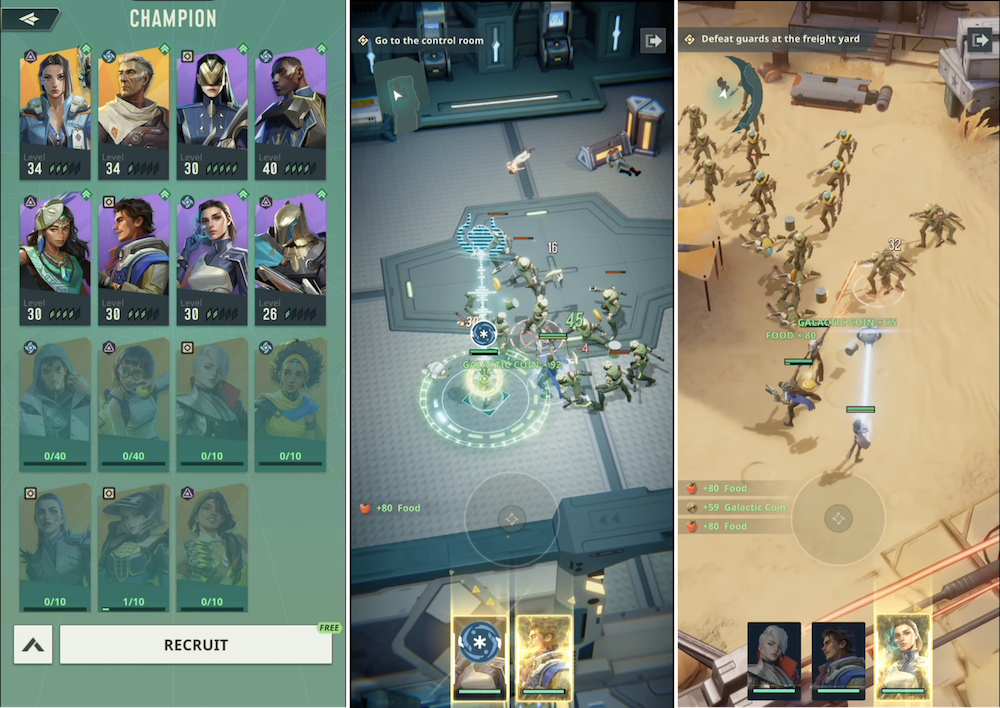

Foundation: Galactic Frontier is FunPlus’s new sci-fi 4X Strategy title set within Isaac Asimov’s Foundation universe as presented in the ongoing big-budget Apple TV series. The game blends traditional base building with an interstellar world map, an RPG character collection meta, and interactive adventure-style PvE levels. Notably, the game also features a sci-fi theme and art style, which have not seen a lot of previous success within the 4X mobile space.

The game demonstrated immediate market traction, hitting Download Rank 1 shortly after its October 20 launch. While download numbers have since cooled, revenue has trended upward, establishing the title as a steady #200 top-grossing performer with a brief peak in the top 100 during early December. This success stands in contrast to the declines in FunPlus’s legacy portfolio, such as State of Survival and Sea of Conquest. Alongside the scaling of Tiles Survive, Foundation represents FunPlus’s latest effort to recapture market share by embracing the hybrid-casualization trend in 4X titles.

2026 Trend Predictions

As the dust settles on 2025, we’ve also taken a step back to consider what might shape the mobile games market in the year ahead. Below, our analysts highlight a few key trends and shifts they expect to define 2026.

1. UGC continues to accelerate across major platforms

2025 was a breakout year for user-generated content (UGC) platforms, with multiple ecosystem players demonstrating that UGC is no longer a niche layer, but a core growth engine.

Roblox continued its strong momentum, growing its player base throughout the year and surpassing 100M+ DAU by year-end. Notably, some of the largest “games” of the year by player count were not standalone titles, but Roblox experiences such as Grow a Garden and Steal a Brainrot—underscoring how creator-led content can now rival traditional game launches in scale.

Fortnite’s UGC ecosystem (UEFN) also had a defining year: UEFN versions of Steal a Brainrot at times exceeded the concurrent player counts of Epic’s official modes, including Battle Royale.

Epic Games announced plans to let creators implement direct IAP monetization, moving beyond purely engagement-based payouts. This marks a major shift toward better incentives and greater creative and commercial flexibility for developers building within UEFN.

Meta expanded its UGC platform, Horizon, from a VR-only environment to mobile. This move strongly signals Meta’s intent to compete for share in the rapidly growing UGC market, a push that is likely to intensify going forward.

Looking ahead, GTA 6 is widely expected to launch next year, with heavy speculation around the direction of the next-generation GTA Online.

Player-driven servers and emergent content have been among the strongest long-term engagement drivers in GTA 5 Online, giving Rockstar clear incentives to more directly and formally support UGC in the next installment.

Taken together, these developments suggest that UGC will remain one of the fastest-growing and most strategically important trends in games for 2026.

2. Hybrid-casual puzzles are driving the next wave of growth

The puzzle genre remains the largest category in the Western mobile market. However, established subgenres, most notably Match3, have become intensely saturated, making meaningful break-in increasingly difficult.

Innovation is instead shifting toward hybrid-casual puzzle games: titles built around simple, hyper-casual–style puzzle cores, layered with IAP-driven systems and live ops, while still leveraging ad monetization.

In 2025, we’ve already seen multiple breakout hits across different puzzle core types using this same hybrid-casual playbook, successfully bringing new blood into the category.

Notably, all of the following titles have scaled into the top 50 grossing games this year:

- Color Block Jam

- Pixel Flow

- Screwdom

- Magic Sort

- All in Hole

What stands out is that each game listed above is built on a distinct puzzle core, yet all follow the same underlying hybrid-casual strategy.

Looking ahead, 2026 is very likely to continue this trajectory, with even more novel puzzle mechanics scaling to the top of the market by applying the same hybrid-casual puzzle playbook.

3. China-based companies continue to expand beyond traditional strongholds in the Western market

For years, Chinese mobile game companies have dominated genres such as 4X strategy and shooters. However, many casual subgenres have historically proven harder for them to penetrate, particularly in Western markets.

That dynamic shifted noticeably in 2025. We saw a growing number of China-originated games breaking out in casual categories, signalling a broader expansion of Chinese developers’ genre mastery.

One of the clearest examples is Merge-2, a subgenre originally popularized globally by Finland’s Metacore with Merge Mansion. In 2025, the category became increasingly led by Chinese studios:

- Microfun (Gossip Harbor, Seaside Escape)

- Century Games (Tasty Travels)

- Happibits (Merge Cooking)

Beyond Merge-2, Century Games also made meaningful inroads into e.g. the fiercely competitive Match3 space with Truck Star, notably targeting a more male-skewing audience.

Toward the end of the year, new Chinese entrants also began scaling in the casual casino segment, a space long dominated by Monopoly GO! and Coin Master. Titles such as Top Tycoon and Carnival Tycoon combined idle/tycoon mechanics with the deep monetization systems typical of casual casino games, allowing them to reach the top 100 grossing apps in the US.

Looking ahead, 2026 is likely to see even more China-originated titles scaling to the top of the charts, including in casual subgenres that have not traditionally been considered “China-dominated” beyond staples like 4X.