Back in October, our friends at GameAnalytics held their second Making Hit Casual Games event, this time focusing on idle games. As usual, they invited the best minds within this particular genre, and were joined by idle experts Homa Games and Kolibri Games. If you would like to see what expert advice they shared, you can find a copy of their decks and recordings here.

Editor’s Note: This post was originally published by Iván Bravo, Director of Customer Operations at GameAnalytics. With years of experience as a data driven marketeer, Iván knows firsthand the difference that having the right data can make.

But for this post, GameAnalytics be digging into their very own session ‘The Latest Trends for Idle Games”, while seeing how idle particularly compares to the hyper-casual genre. Here’s a copy of the recording, if you’d prefer to watch instead.

A bit about GameAnalytics’ data

GameAnalytics featured a heck of a lot of insights in this talk, with aggregated data from over 1.2 billion monthly players, across 80K games from Q3 2018 through to Q2 2019. For this session, they primarily showcased data in two different plot points: time-series (for trends), and stacked bar charts (for genre benchmarks). They both show a number of different quantiles (bottom 25%, median, top 25% etc).

GameAnalytics actually just launched an interactive dashboard featuring their large dataset, which lets you filter down by genre level for up to the top 5% of games. Check it out for yourself here.

Now that you’re familiar with their graph types, let’s dig in…

TLDR; Stats at a glance

- Players of idle games show a stickiness of 18% (whereas it’s 10.5% for hyper-casual titles).

- Idle gamers show a higher number of sessions per day (5.3 sessions vs 4.6 sessions in hyper-casual titles).

- They have a higher average session length than hyper-casual – 8 minutes.

- There’s a steady decrease in retention for idle games (a sign that the market is growing).

- Idle is the leading performer within the Arcade genre (their position stays within the top 5 from D1 to D28).

- Their average revenue per daily active user (ARPDAU) is 9 times as much as the hyper-casual genre.

Idle gamers play longer and more frequently than hyper-casual players

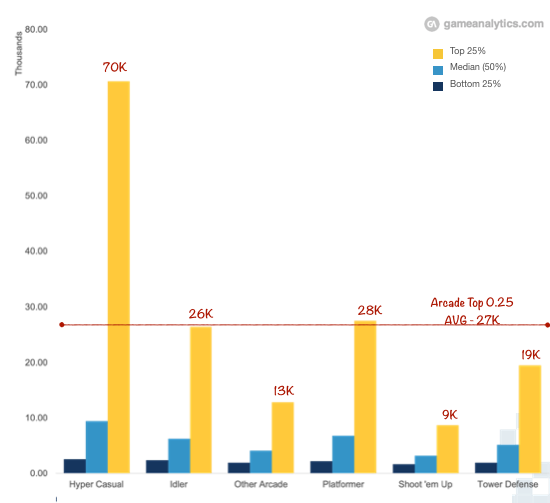

When we look at the daily active users (DAU) of both genres alone, hyper-casual games seem to be taking the lead – especially when a hyper-casual title in the top 25% can have over 70K active users on an average day.

But what idle games lack in DAU, they make up in session length and stickiness. For example, players in this genre are more engaged. They play marginally more sessions per day (5.3) than hyper-casual gamers (4.6 per day).

And when we looked at stickiness, we found out idle games are showing a much higher stickiness (18%) and are in the lead within the Arcade genre. Which means players are returning regularly. We also saw that players actually spend twice as much time per session than the hyper-casual genre. Their average session length is 8 minutes, whereas it’s only 4.5 minutes for hyper-casual.

In short, hyper-casual may have more users playing every day, idle gamers are more engaged, and actually play more frequently than hyper-casual players. For anyone making an idle game, perhaps keep this in mind when developing your games’ average session time. If it doesn’t last for up to 8 minutes, then it may not be enough for your players.

A steady decrease in retention for idle titles

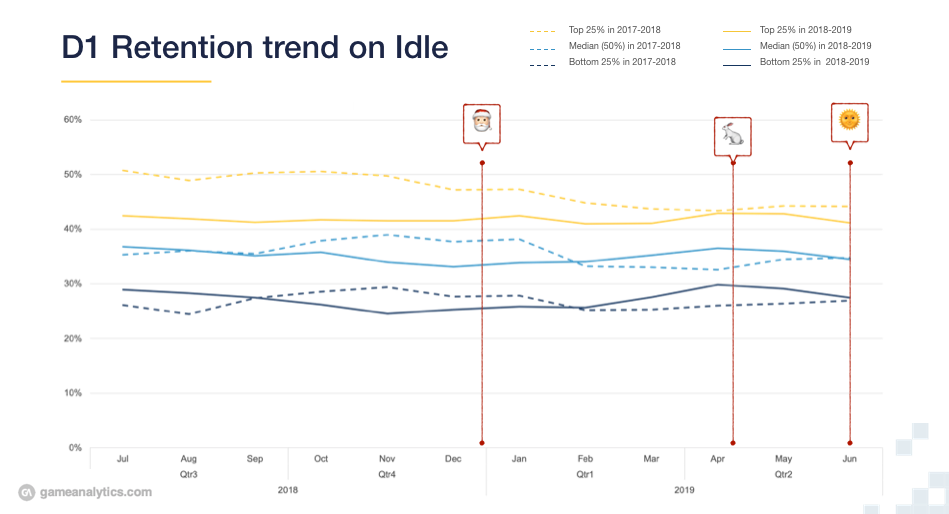

For retention, the top 25% of idle games take the lead right from D1 – reaching as high as 42%. And in general, retention also appears to be always rising above the median – which is around 35-36%. Comparing the retention rate for idle against the overall Arcade genre, we can see that it’s generally easier for this genre to retain users.

If we dive a little deeper and look at D7 retention for all the subgenres within the Casual category, idle drops to third place (14.5%) – falling behind Word & Trivia (17%) and Match3 (18%). By day 28, this category slips to fifth place (5.5%) but still ends up outperforming the rest of the sub-genres within the Arcade category again.

In a nutshell, there has been a steady decrease in retention for idle games, which could be interpreted as a possible sign that the idle market is not only growing in size, but also in competition.

If you see your D28 retention decreasing, then it’s worth focusing your attention on game content. As Nate Barker from Kolibri Games has put it in his session, keeping your players engaged is a way of keeping your retention healthy. He also added a list of things that you can do to keep players hooked on your title (see lesson #7).

If you’re interested in learning more about how you can boost your game’s retention and engagement, have a look at these five key lessons as well.

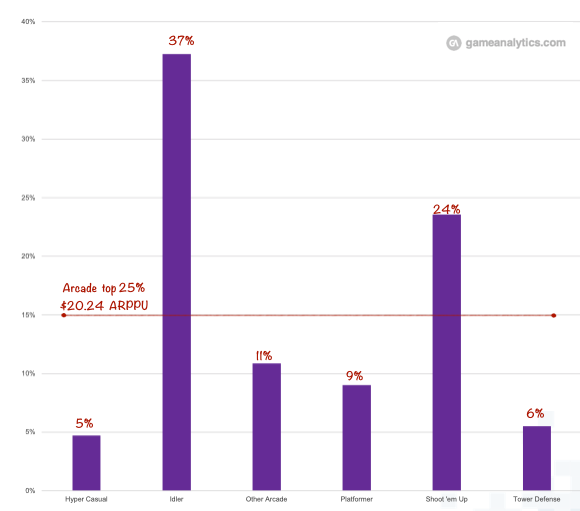

Monetize this – Idle’s IAP upper hand

Idle plays the IAP game better than a large number of genres. How so? The genre is more at home with this kind of revenue stream, so much so that we estimate as many as 37% of Idle games primarily monetize using this strategy. It’s something of an outlier compared to other genres, as the nearest best-performer at IAPs is Shoot ‘Em Ups, of which 27% use IAPs.

To put this into perspective, just 5% of hyper-casual games are able to work this way. And as Idle has almost double the time to play with (thanks to those longer sessions), it’s worth pushing those IAPs out.

As mentioned in Kolibri’s session, you should base your monetization strategy on ‘pay or wait’. But it’s important to keep new content going out if you are going to do this, or risk your retention taking a hit.

How does your game perform compared to its genre?

In this post, GameAnalytics took a quick look at how idle and hyper-casual games have been performing for metrics like engagement, retention, and monetization from Q3 2018 to Q2 2019. If you’re interested in diving deeper and seeing how your own mobile game compares to its genre, then you should definitely check out their new mobile gaming intelligence platform, Benchmarks+.

If you have any questions or would like to get in touch to chat more about GameAnalytics’ event series or Benchmarks+, feel free to ping them at insights@gameanalytics.com. Their next event will be on Puzzlers, which they’re hoping to host again in London either February/March.